How To Save So That You Stop Going Broke Every Month

Mike Tyson is a popular man today.

A large portion of his fame is a result of his illustrious career as a boxer.

A large portion of his fame is a result of his illustrious career as a boxer.

Even today, many years after his retirement as a professional boxer, you would think Mike Tyson is a tiger at first glance.

Until you look closer and discover he’s a man like you, but with a much tougher face.

Until you look closer and discover he’s a man like you, but with a much tougher face.

Mike Tyson was a valiant boxer. Tireless and an ever-present thorn in the sides of his opponents.

And when you discover that he was a former world heavyweight champion, you nod in agreement.

In November 1986, at the age of 20, he became the youngest heavyweight champion in boxing history.

In November 1986, at the age of 20, he became the youngest heavyweight champion in boxing history.

Tyson won 50 of his 58 professional fights winning 44 by knockouts.

In his 27 fights that were tracked by CompuBox, he landed 56 percent of his power punches, which is 15 percentage points higher than the heavyweight average. It sounds like what this man could do.

In his 27 fights that were tracked by CompuBox, he landed 56 percent of his power punches, which is 15 percentage points higher than the heavyweight average. It sounds like what this man could do.

|

| Source: Wikipedia |

One other thing that came with his success in the ring and popularity off it, was a lot of money. An amount whose mention could make your ears tingle.

He had made about 400 million dollars over the 20-year span of his career.

He had made about 400 million dollars over the 20-year span of his career.

Yet, in 2003, he was more than 27 million dollars in debt as he declared bankruptcy.

He announced his retirement in 2005, but he had to return to the ring again to pay off his debts.

He announced his retirement in 2005, but he had to return to the ring again to pay off his debts.

You’ll probably be tempted to ask: did Mike Tyson have a load of termites eating money in his house?

Maybe. Or maybe not if you consider his actions before retirement.

Maybe. Or maybe not if you consider his actions before retirement.

Some of the things Mike Tyson wasted his money on include:

- Having 110 cars which included a Rolls Royce, multiple Bentleys, Ferraris and Lamborghinis, a Range Rover and a Mercedes Benz 500.

- Spending $3.4 million on clothes and jewelry.

- Spending $7.8 million on personal expenses.

- $2 million for a golden bath tub for his first wife, actress Robin Givens.

- $410,000 on a birthday party.

- $230,000 on cell phones and pagers during a three-year period from 1995 to 1997.

- Employing as many as 200 people, including bodyguards, chauffeurs, chefs, and gardeners.

Tyson’s profligacy can be captured best in 2000 when he got new accountants.

They had prepared a statement that showed him entering the year $3.3 million in debt.

They had prepared a statement that showed him entering the year $3.3 million in debt.

However, he made $65.7 million that year. But if you were expecting him to end that year with a lot of money, you're sadly mistaken.

“The problem was that I spent $62 million that year,” Tyson said.

As much as he loved knocking his opponents out in the ring, he also loved his life of luxury off the ring, or to be frank, life of wastage.

Ever been in a tight spot?

What would it be like when you find yourself in a tight spot? It’s easy to believe that your rosy financial situation will continue but that's not usually the case.

What's the plan when income goes below your expectations or you make losses in your business?

What's the plan when income goes below your expectations or you make losses in your business?

Are you going to starve until you get out of the bad situation? Or use your credit card to get yourself into more debt.

It’s usually bad when you don't make money. But it’s even worse when you have not saved for the rainy day.

It’s usually bad when you don't make money. But it’s even worse when you have not saved for the rainy day.

Many times, you may have heard ‘spend the money you have so that you can leave space for more money to come in.’

When you hear this statement again, block your ears and if possible, run for your life.

When you hear this statement again, block your ears and if possible, run for your life.

Because this statement is poisonous at best. The only space you’ll be leaving is for misery and frustration.

As much as I’ll love to make you happy, I must also tell you the truth, which may be bitter to swallow, but better for your financial health.

Let me start with the blunt truth that most people shy away from: you’re largely in control of whatever happens in your personal economy.

Let me start with the blunt truth that most people shy away from: you’re largely in control of whatever happens in your personal economy.

It is comforting to put all the blame on the government or external influences and the truth is that the government may have a negative or positive impact on your financial opportunities.

But the government doesn't spend your money for you. You do.

But the government doesn't spend your money for you. You do.

How bad is the saving situation?

In the United States, there is a personal savings rate of 2.4 percent.

Generally, 18 percent of Americans have savings of less than $1,000. Also, about 1 out of 5 women (21 percent) in the United States have savings of less than $1,000.

Generally, 18 percent of Americans have savings of less than $1,000. Also, about 1 out of 5 women (21 percent) in the United States have savings of less than $1,000.

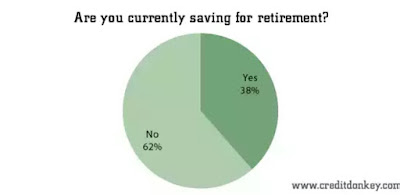

According to a survey by CreditDonkey, 54 percent of respondents have no strategy for saving money. And 62 percent said they are not saving for retirement.

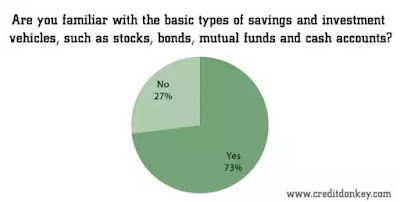

This is despite the fact that 73 percent are familiar with different types of investment options like stocks, bonds, mutual funds, and cash accounts.

This shows how people have neglected the habit of saving.

This shows how people have neglected the habit of saving.

It is important to save no matter how small the amount you make.

This post is going to tell what you need to know to save for the rainy day. Below are some tips that will help you to save more money if you can follow them.

This post is going to tell what you need to know to save for the rainy day. Below are some tips that will help you to save more money if you can follow them.

- Set your monthly savings target

If you're serious about saving, then you need to set your monthly target. This could be a minimum amount or a percentage of your monthly income.

If you're going to set a percentage, it's advisable to set a savings target of 10 percent of your income.

If you're going to set a percentage, it's advisable to set a savings target of 10 percent of your income.

Many have complained that they find it impossible to save because they earn too little. But there is never an excuse to spend all your earnings.

Even if you earn 1000 dollars monthly, you may see it as poverty levels of earning.

But you can still save even 10 dollars out of that amount. So far you can survive on that 1000, you can get 10 out.

But you can still save even 10 dollars out of that amount. So far you can survive on that 1000, you can get 10 out.

Sometimes, it’s not about the amount you save, but the discipline to save itself.

Thornton T. Munger said: “The habit of saving is itself an education; it fosters every virtue, teaches self-denial, cultivates the sense of order, trains to forethought, and so broadens the mind.”

The problem with spending everything when you earn a meager amount of money is that you'll also spend everything when you start earning thousands and millions.

If you don't believe me, check the story above again.

If you don't believe me, check the story above again.

In this age, it's easy to spend everything you earn even without leaving your house. Online stores have made this so easy.

And not only that. If you're not careful, before you know it, you’re in a deep pit of debt.

And not only that. If you're not careful, before you know it, you’re in a deep pit of debt.

If you're not used to saving, set a small target you believe you can meet. No matter how small it may be. If you're able to achieve it, then you can set bigger targets.

- Journal your daily spending

Most times when you ask people how they spent their money, they just open their palms, helpless, and say: ‘I don't know.’

To them, it is a mystery how they spent all that money. They were supposed to have at least 5,000 dollars but nothing is remaining.

To them, it is a mystery how they spent all that money. They were supposed to have at least 5,000 dollars but nothing is remaining.

In fact, some people can go as far as claiming that it was a spiritual attack that took all their money away.

But the real story is that they lack consciousness of how they spend their money.

But the real story is that they lack consciousness of how they spend their money.

If you lack consciousness of how you spend your money, it can be very difficult or almost impossible to save your money because you don't know when or where you're wasting it in the first place.

If you lack consciousness about an event, you don’t know whether it's going well or badly.

When you have the consciousness that you're wasting money or spending it wisely, you're able to take the necessary actions.

When you have the consciousness that you're wasting money or spending it wisely, you're able to take the necessary actions.

To gain this consciousness, have a journal for writing how you spend money daily.

At the beginning of the month in consideration, you state your total income from the previous month.

At the beginning of the month in consideration, you state your total income from the previous month.

You can have a separate journal or another part of this one where you write your income especially if you are a businessperson who doesn’t earn a salary.

At the beginning of each day, write the date. During the course of each day, you spend money.

It’s easier to remember how you spent your money during a particular day than say a week or month.

It’s easier to remember how you spent your money during a particular day than say a week or month.

That's why I’m advocating for a daily journal. It’s easier to remember and therefore more effective.

If you’re not used to it, you may forget to enter the journal on some days or even forget your daily spend.

If you’re not used to it, you may forget to enter the journal on some days or even forget your daily spend.

You can set a daily reminder on your smartphone in the night to prevent missing days.

- Analyse your spending at the end of the month

If you have no records of your daily expenses, how do you analyse your monthly expenses?

It’s almost impossible, except you have a magnetic brain. And most of us don't have it.

It’s almost impossible, except you have a magnetic brain. And most of us don't have it.

If you journal your daily expenses diligently, you can know accurately where your money went to last month.

This is where people see many things that have been invisible to them.

This is where people see many things that have been invisible to them.

Did you just spend 25 percent of your monthly income buying beer? And 18 percent to buy fuel when you know that most of the fuel is consumed when you go around greeting your friends or partying?

Over a month, you’ll find the weak points of your spending and where you need to block to save more.

Most importantly, you’ll also know whether you have been able to save during the course of the month.

Most importantly, you’ll also know whether you have been able to save during the course of the month.

Of course, some salary earners know they have no savings in a month because they are already broke before their next salary.

If you keep your journal properly, you’ll know where all the money went. And even if a spirit blew it away, you will know where the spirit blew it to.

If you keep your journal properly, you’ll know where all the money went. And even if a spirit blew it away, you will know where the spirit blew it to.

Most importantly, this analysis will help inform a behavioral change if you're serious about saving.

If you can cut your largest form of spending and eliminate some activities totally, you have more opportunities to save.

If you can cut your largest form of spending and eliminate some activities totally, you have more opportunities to save.

- Set another target

After your first month of trying this, you may end up not saving anything. But now, you know why. Saving is a long-term activity.

You can set the same target you set the previous month or adjust it according to insights from your analysis. Now, you're more prepared for success in saving.

- Eliminate the source of wastage

In the previous month, you can easily point out means through which you wasted a lot of money unnecessarily.

With your continual journalling of your daily expenses, you can also set targets of eliminating some behaviors that lead to wasteful spending.

With your continual journalling of your daily expenses, you can also set targets of eliminating some behaviors that lead to wasteful spending.

Do you socialize too much and lose a lot of money through it? Do you spend impulsively without really having a need for the things you’re buying?

Do you go to the supermarket without a list and end up spending 50 percent more or even double the amount you planned to spend?

These are activities you can tone down on. Like they say, the devil is in the details.

You lose 1 dollar here, 50 cents there, and before you know it, you have lost thousands. And it you save those small amounts too? You save thousands.

You lose 1 dollar here, 50 cents there, and before you know it, you have lost thousands. And it you save those small amounts too? You save thousands.

- Analyse your results

At the end of the second month, you should have achieved some progress if you committed your mind to it.

The key is that there is no perfect spend. Which means there is always a room for improvement.

The key is that there is no perfect spend. Which means there is always a room for improvement.

When you analyze your results, you’ll detect the points where you need to change.

You can refine these steps or even add more to it as you see fit. Especially if it will enhance your habits of saving.

You can refine these steps or even add more to it as you see fit. Especially if it will enhance your habits of saving.

Poor? You need to save

It may be difficult to save if you're poor. However, the poor need to save more than any other financial set of people.

Because this is the only opportunity you have of becoming rich one day.

Because this is the only opportunity you have of becoming rich one day.

If you can't save out of the little you earn now, then how can you pursue business opportunities that you have in the future?

If you can save a little, then investing a small amount of money can lead to making much more.

If you can save a little, then investing a small amount of money can lead to making much more.

Set your savings aside first

Another way you can go about saving is to set aside the amount you want to save in an account specifically for saving.

Although this may be more applicable to people who earn salaries, it may also work for business people when they receive a lump sum of money.

Although this may be more applicable to people who earn salaries, it may also work for business people when they receive a lump sum of money.

As Warren Buffett said: “Do not save what is left after spending; instead spend what is left after saving.”

Saving is a prerequisite to investing

Many times, you may have heard that the best way to use your money is to invest it. But most times, we don't invest daily.

Most times you need a bulk of money to invest. If you can't save, how then can you get the money to invest?

Most times you need a bulk of money to invest. If you can't save, how then can you get the money to invest?

Have you ever seen a great investor who is/was a spendthrift? I don't know of any.

Conclusion

Mike Tyson was able to turn his situation around but he admitted it took a “whole deal of rehabs and institutions.”

“I’m one of the lucky ones,” he said.

Not everybody got lucky. In fact, many people got into problems due to their spending habits.

Prevention is always better than cure. Save your money today and you'll have an opportunity to invest it tomorrow.

Continue to waste your money and you’ll have to endure being in a perpetual struggle against self-made woes.

Continue to waste your money and you’ll have to endure being in a perpetual struggle against self-made woes.

I’ll leave you with the words of Dave Ramsey who said: “You must gain control over your money or the lack of it will forever control you.”

How do you save? If you don't, what's your plan towards saving? Tell me in the comments.

To read more about personal and career development, visit the home page.

If you want me to write for you or your business, I’ll be delighted to help you achieve your targets through copywriting.

Comments

Post a Comment

I'll like to know what you think!